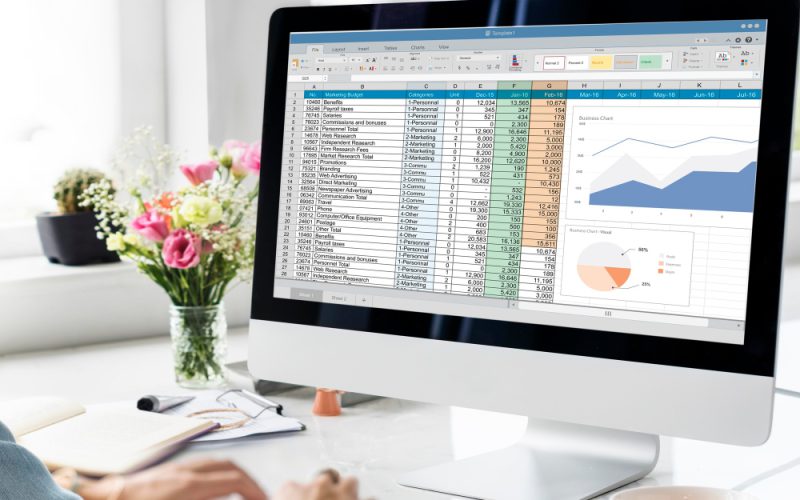

The business press regularly announces the programmed disappearance of the accounting profession under the effect of automation and artificial intelligence. This catastrophic view ignores the reality on the ground: AI does not eliminate the accounting profession, it removes repetitive tasks and enhances human expertise. The accountant becomes the controller and analyst of algorithmic outputs, with a role that evolves towards more strategic advice and the interpretation of complex situations.